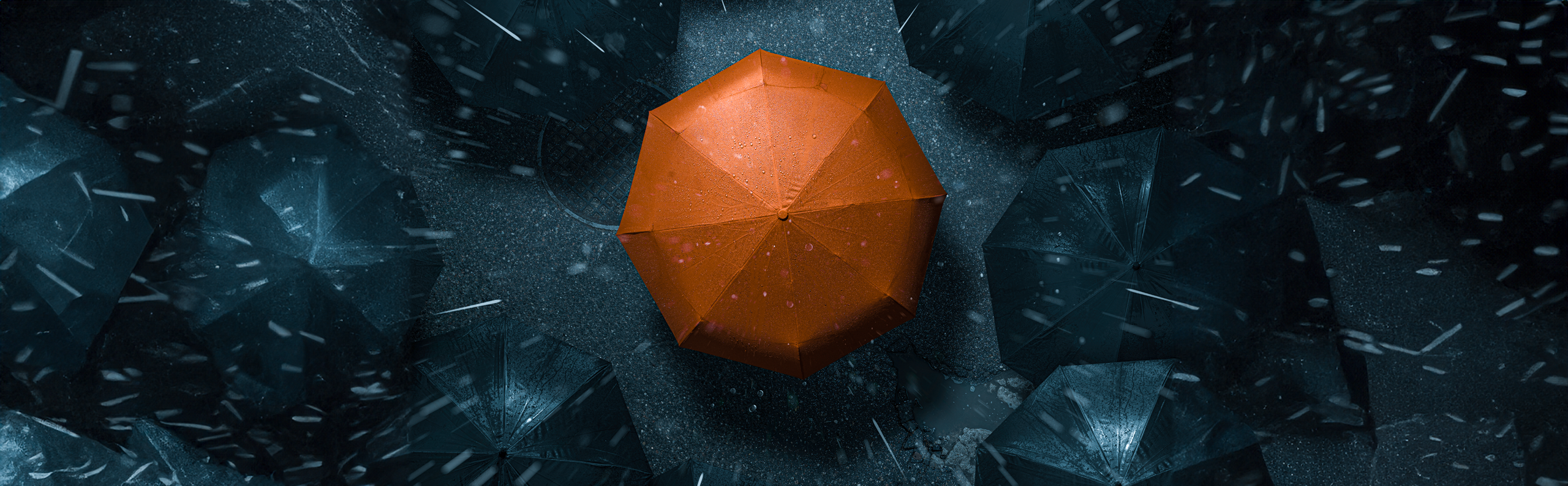

We all understand the value of protecting what matters most to you, which is why you purchase insurance policies such as home, auto, life, and health. While these policies offer essential protection, they may not always be enough to protect you and the ones you love from circumstances beyond your control. This is where an umbrella insurance policy could make all the difference, extending beyond the limitations of conventional policies and offering more extensive coverage for life's unpredictable moments.

What Is Umbrella Insurance?

Umbrella insurance provides additional liability coverage that extends beyond the coverage of your auto and homeowners policies. Your typical policies, such as home and auto, have a coverage limit, which could leave you paying out-of-pocket for some expenses, medical bills, or more depending on the accident. Umbrella insurance coverage kicks in once the limits of your primary policies have been met. One great benefit of umbrella insurance is the flexibility it offers. It can be applied to various situations and aspects of your life, as well as cover other members of your family or those within your household.

In addition, umbrella insurance is designed to protect you from financial losses due to lawsuits, legal fees, and damages awarded to third parties. It covers a range of liabilities, such as bodily injury, property damage, slander, and landlord liability. While you might think you'll never find yourself on the receiving end of a lawsuit, you never know when you may find yourself in need of this extra protection.

What Situations Would an Umbrella Policy Be Beneficial?

Imagine you're involved in a car accident where you're at fault, resulting in severe injuries to the other driver and passengers. While your auto insurance may cover a portion of the medical expenses and damages, it may not be enough to cover all of the costs. Your umbrella policy can be used to cover the remainder of the medical bills, protecting you from having to pay the additional expenses.

Or, consider you're having a party at your home and a guest falls down the stairs, breaks their leg, and suffers a concussion. They sue you for their medical bills, as well as their pain and suffering. An umbrella policy would help cover the settlement costs, medical bills, and lawyer fees. It's also important to consider getting an umbrella insurance policy if you have a teenager at home, a swimming pool, a pet (particularly a dog), a boat or other watersport equipment, or you own rental properties.

Who Should Consider an Umbrella Policy?

While umbrella insurance is beneficial for anyone looking to protect their assets, some individuals can significantly benefit from this policy. Individuals who are homeowners, auto owners, small business owners, or who have high liability careers, such as doctors and lawyers, could all find this extra coverage beneficial. Likewise, families and individuals with a high net worth should also consider investing in an umbrella policy.

We know we can't predict the future, but we can prepare for it. Having an umbrella policy can make the most difficult situations easier to navigate, allowing policy owners to know they have extended coverage if the unimaginable happens. Contact a Mulling insurance agent today to see if an umbrella policy is right for you!

Kevin Mulling, CIC | Vice President

Kevin Mulling, CIC | Vice President

As Vice President of Mulling Insurance, Kevin uses his decades of insurance industry experience and knowledge as a Certified Insurance Counselor (CIC) to help customers with their policies. He takes pride in leading his team and carrying forward the family business's strong commitment to community and family values.